Dear Reader,

Well, The Donald has shown Amazon that he still wields a modicum of power — at least until he takes his final helicopter ride away from the South Lawn.

Here’s what he tweeted at 3 o’clock Wednesday morning:

Amazon is doing great damage to tax paying retailers. Towns, cities and states throughout the U.S. are being hurt — many jobs being lost!

The online retail giant was soon hemorrhaging $5.7 billion of market value. Amazon stock slipped as much as 1.2% in pre-market trading.

And with that middle-of-the-night tweet, Trump unloosed a major warning shot across the bow of S.S. Amazon.

Yes, The Donald is well on his way toward his last helicopter ride. But I’d bet on Trump launching a major regulatory or antitrust attack on Amazon as he finally goes down in flames.

Make no mistake, I believe fully in the virtues of free market capitalism. I further recognize the considerable entrepreneurial prowess of Jeff Bezos and his army of disrupters.

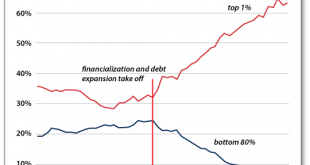

But Amazon is less the work of free market capitalism and its gales of creative destruction than it is the mutant child of Bubble Finance.

Bubble Finance is profoundly destructive because it distorts the signaling system of everyday capitalism. In turn, that causes sweeping malinvestments, irrational economic decisions and the vast waste of real economic resources.

In carrying out its scorched-earth policies across the retail landscape, Amazon is not doing God’s work. It’s functioning as a giant predator motivated by false incentives to destroy perfectly serviceable assets, business operations and jobs.

It is now estimated that 30,000 retail stores will close over 2017–19 due to Amazon’s relentless attack. That’s nearly three times the 12,000 stores that closed from 2014–16.

But let’s face it: Amazon is not a startup — it’s almost 25 years old. And it hasn’t invented anything explosively new like the iPhone or personal computer. Instead, 91% of its sales involve storing, moving and delivering goods — a sector of the economy that has grown by just 2.2% annually in nominal dollars for the last decade.

And after nearly three decades of operation, Amazon still generates limited operating free cash flow relative to its nosebleed valuation. It has never made a profit beyond occasional quarterly chump change.

Simply put, it has never, ever generated any material free cash flow. What’s more, Jeff Bezos — arguably the most maniacal empire builder since Genghis Khan — apparently has no plan to ever create any.

The fact is Amazon is one of the greatest cash burn machines ever invented.

And at 182X earnings, Amazon is an out-and-out bubble. There is simply no macroeconomic basis for Amazon’s insane valuation.

In an honest free market, Jeff Bezos would be more than welcome to run a profitless growth machine. But it would also be valued accordingly.

I will readily grant that Bezos is a visionary and great capitalist innovator, builder and disrupter. But I would also lay heavy odds on the probability that his business strategy might be dramatically different — and far more profit-oriented — under an honest free market.

In fact, based on the true facts of the Amazon e-commerce juggernaut, I think Bezos’ assault on the brick-and-mortar sector would be far less menacing and reckless in that scenario. And that’s giving full credit to the fact that online shopping and nearly instant delivery of goods is an enormous consumer boon that would be making great inroads even in an honest free market.

But it wouldn’t happen nearly as rapidly or disruptively, because Amazon would be required to post a reasonable profit. And its stock price would reflect that reality, instead of riding the ridiculously false highs of Bubble Finance.

Indeed, the chart below leaves nothing to the imagination. Since 2012, Amazon stock price has bounded upward in nearly exact lock step with the massive balance sheet expansion of the world’s three major central banks:

Needless to say, none of this is happening in an economic vacuum.

What the Fed has actually unleashed is not true creative destruction. It’s merely unleashed a rogue business model and reckless sales growth machine that is just one more example of destructive financial engineering and still more proof that monetary central planning fuels economic decay, not prosperity.

Regards,

David Stockman

for The Daily Reckoning

Source link

Best Stock Hints Latest Tips To Buy & Invest Best Stocks Today

Best Stock Hints Latest Tips To Buy & Invest Best Stocks Today