Nearly every single book out there will promote diversification by sector with one strategy as simple as spreading your hard earn money evenly across sectors.

I started with that, and even rebalanced annually. It was an epic fail for portfolio performance. In fact, the Canadian market barely covers many of the sectors … See below on how poorly some of the sectors are represented.

Other strategies will say to avoid having too much invested in one sector, while others will say to not have more than a specific percentage in one company.

Pick a way to break it down by sector, and chances are, it has been written about it.

But does that mean it’s good advice?

Dividend Earner Portfolio Diversification

For the most up-to-date diversifiation, it’s best to refer to the dividend income reports, but for context and illustration, here are the graphs of my portfolio.

Am I overweight in the financial services sector? I don’t feel like I am but do you think I am? If so, why? Share your answer in the comments

Here is another view to match the TSX Composite and the TSX 60 throughout the article.

I don’t believe I am overweight simply because there are three very specific industries with small overlaps.

- Banks – Diversified: Those are the big Canadian banks.

- Asset Management: That’s a discretionary company not easily classified. BlackRock is an ETF company, whereas Brookefield Asset Management buys and manages businesses and was previously classified as a real estate business.

- Credit Services: Those are the mega conglomerate credit card companies.

- Insurance – Property & Casualty: That’s insurance for buildings, and businesses in general.

- Insurance – Life: That’s pure play life insurance companies.

After going through the five industries I have invested in which are in the financial services sector, do you still believe I am overweigth? Or more specifically that there is a risk?

Investing in Canadian blue-chip stocks is practically selecting from the TSX60, and filtering by dividend paying stocks. Does it look diversified to you?

Diversification Is All About Risk Perception

One title I thought of originally using was “Sector Diversification Is Now Absurd” but I thought I was being a bit too dramatic … but that’s really what I think though.

That title was meant to challenge all the learnings we have had from the investment world. All the books, and all the advisors are talking about sector diversification. Think back of how mutual funds are suggested as great investments … Thinking at the sector level is just simpler, but not better.

Also note that sector diversification doen’t work in Canada. 50% of the stocks are in the financial and energy sectors.

As such, sector diversification needs a second thought in my opinion, and the rest of the article is meant to challenge anyone to think through it.

Do you approach sector diversification for the best performance of your portfolio? or for the best night sleep with no stress? It’s usually the latter.

I also believe that it prevents financial firms from getting a million calls from angry investors because many of them don’t understand economic cycles along with the recoveries.

Instead of taking the time to explain how investments will move over time, investment firms want less work so they tell investors to spread their investment along the graph so that they pretty much even out each other …

When you focus on minimizing drops, you also consequently minimize increases. Often times, investors will get frustrated when their portfolio doesn’t keep up with an index during a recovery … and push the advisor to be more aggressive, and vice versa.

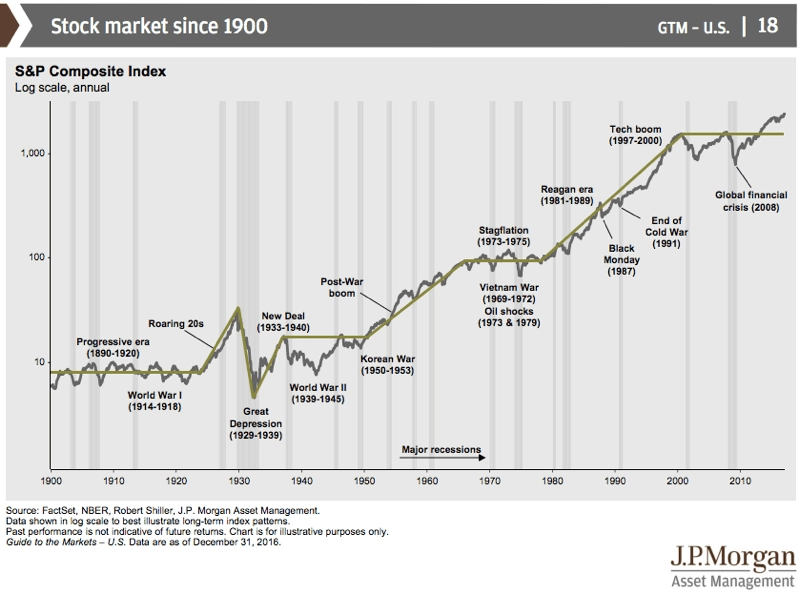

The reality is that there is always a recovery, and great companies will always strive.

Ignore sector allocation for a minute; what are the golden rules of dividend investing?

- Don’t buy stocks that drop the dividend

- Don’t buy stocks that cut the dividend

- Only buy stocks that increase the dividend annually (this is how you keep up with inflation)

- Only buy stocks that can do that through the good and the bad economic cycles

- DRIP at all times for dollar-cost averaging

If you follow those rules, why do you need to worry about the economic cycles, and sector diversification? Tell me, I am really curious why the sector matters in the above points.

Oh wait, it’s becaus the stock might drop during a recession, and that doesn’t feel good… but that’s only temporary. History can show you how the banks recover along with many other companies.

During a recession, if you are not looking for amazing companies at a discounted price, then something is not right with your portfolio, and strategy. The recession is not the problem.

Let’s be clear, you want to sleep at night, ignore all of this and buy a broad market index.

You Can Be Over-Diversified!

Yes, you can be over-diversified. How is that possible?

Diversification is protection against ignorance. It makes little sense if you know what you’re doing.

Warren Buffett

Remember why you invest? Why you chose not to keep your money in the so-called high interest savings account?

You invest to make money. When you keep on diversifying, you spread your money and expect all of your investments to be winners. Unfortunately, there aren’t that many winners out there.

In fact, look at the BNN Top Picks, many stock analysts pick the same stocks which are winners in many portfolio. Why would you want to limit your exposure to those winners.

I have 27 tickers in my portfolio and 50% of my portfolio is in 8 stocks, and 80% in 15 stocks.

Is the fear of an Enron Scandal what is making you over-diversify? While also making you leave a lot of money on a table by taking profits from your winners …

Think about it, when you have taken profits from a winner, did you put it in another winner? or was it a coaster? I have been there, and I have taken profits from my winners only to regret it.

I often hear the saying, “nothing wrong with taking profits” but what does that really mean? This isn’t a poker game … When you sell stocks, it means your money isn’t working anymore, so the assumption is that your investment thesis on the company you took a profit from has changed. If so, that’s a smart move. If it has not, then why are you selling?

If you tend to own the TSX 30 or a large portion of the TSX60, why is that? It’s definitely not to build weath as they aren’t all that great for growth. You are better buying the S&P500 index ETF, or at least XIU to capture the TSX 60 ETF for simplicity.

Chances are, you are buying stocks with a good yield, and that’s a poor approach to spread across sectors thinking you are managing risks. Stick to the best of them and add some covered call ETFs o boost your yield.

Sector Categorization Go Through Updates

In 2018, with FinTech companies and massive technology conglomerates, the governing bodies have reclassified a number of companies. The primary sector reshuffled happened in the communication services sector. For example, Meta and Disney are now Communication Services companies next to Telus, BCE and AT&T.

Did that shift your ratios? What are you doing about it? Adjusting your plan or trimming the sector?

Companies also evolve. Take BAM, for example, it used to be a real estate company and now it’s an asset management firm and assigned to the financial sector. The company isn’t that much different in how it does business, but if you were equal weigth between financials and real estate, that shift would have changed your portfolio sector ratios.

What do you do? Sell BAM? Sell the banks?

Sector classification adjustments are made out of necessities, and there are two governing bodies. While similar, they also have slight differences in classification.

Defense vs Offense: A Simpler Classification

Let’s make it super simple! Go with offensive, defensive, and neutral categorization.

The idea here is that defensive stocks are there to protect your lead, whereas your offensive stocks are there to increse your lead. Neutral stocks neither excel at both.

What’s the difference with sectors? Isn’t that what sectors do? Well, I believe it was the intention, but as I demonstrated, the communication services sector can no longer be defensive when Meta, Activision, or Disney are included.

It all comes down to qualifying the businesses. As an investor forcused on the offense, I have classified stocks in the Dividend Snapshot Screeners with a tollbooth type of business, and some of them are more offensive than others and it shows through the dividend growth, and chowder score.

Don’t diversify by sector, focus on industry and then classify your investments as offense, defense, and neutral. You’ll still need to decide on a ratio …

The other classification you want to do is market capitalization also provided by default with the screeners. The smaller the company, the riskier basically. Since you look at sector diversification to manage risks, company size also plays a part …

Offense Is The Best Defense

Much of the diversification strategies come from trying to simplify investing, and more specifically the understanding of risk.

Instead of teaching about risk, and how to deal with risk, the firms, and books, look for ways to make you invest with a simple set of rules without explaining the reasons behind the rules.

Over time, great companies will recover, and the stock market always goes up over time.

Here is my portfolio in 2022, see how it started dropping starting in January, and now it’s almost back to the same level. I wasn’t sitting idle though as I did add some money, but I have not sold.

Recessions are discount moments, not panic moments.

Sector Diversification Is Not Asset Allocation

The two concepts are different.

Investing in REITs is not investing in real-estate as many would like you to believe. You invest in a business that deals with real-estate assets but you have no control over the business decisions and their money management.

REITs dropped during the pandemic but residential real assets went up. So you see, the equity doesn’t always match the asset.

I also do not like to qualify a bond ETF as a fixed income asset. ETFs by nature are equities with underlying fixed income assets.

A bond maintain its value at the end of the term, the bond ETF doesn’t. Why don’t you just buy bonds yourself? Your broker has the ability to let you do that. You can build your own laddered bonds.

Source link

Best Stock Hints Latest Tips To Buy & Invest Best Stocks Today

Best Stock Hints Latest Tips To Buy & Invest Best Stocks Today